Tax News & Views Big Beautiful Bill Jumps Again Roundup

Budget committee reverses, advances "Big Beautiful Bill." Energy credits at risk? IRS staff re-hired. IRS commissioner hearings this week. Frog festival.

Key Takeaways

Late-night session advances budget bill.

A deal to cancel energy credits earlier?

The week ahead for the bill.

IRS reportedly asks fired staff back.

Commissioner nominee Billy Long hearings this week.

Scammers and the vulnerable.

Frog jumping jubilee.

Trump’s tax and immigration bill clears hurdle after late-night vote - Marianna Sotomayor and Mariana Alfaro, Washington Post:

The House Budget Committee passed a massive tax and immigration package central to President Donald Trump’s agenda late Sunday, overcoming opposition from hard-line conservatives over spending.

Four fiscal conservatives — all deficit hawks aligned with the ultraconservative House Freedom Caucus — changed their vote to “present,” allowing the legislative package to be recommended “favorably” to the House, 17-16. But their hesitance to vote the One Big Beautiful Bill Act out of committee is a reminder that the far-right flank of the Republican conference remains skeptical.

This week: Reconciliation bill back on track, at least for now - Niels Lesniewski, Roll Call:

Rep. Chip Roy, R-Texas, one of four conservative Budget Committee members who agreed to vote “present” Sunday to allow the House to move forward with the bill designed to implement Trump’s policy agenda, said in a statement, “the bill does not yet meet the moment.”

The Rules Committee is scheduled to convene at 1 a.m. Wednesday to set the ground rules for floor debate on the measure after releasing an updated committee print version of the legislative text overnight.

Among the newest changes is the removal of a provision opposed by Rep. Michael R. Turner, R-Ohio, that would force federal agency employees, lawmakers and congressional staff to contribute more of their salaries to their pension plans. The effective dates of two other pension-related provisions would be delayed to 2028.

1 a.m.? Yes, 1 a.m.

Capitol Hill Recap: The House Budget Bump in the Road - Alex Parker, Eide Bailly. "But just because there’s a script, doesn’t mean that everyone will follow it. That’s what the party leaders found out Friday morning, with four conservative Republican members announcing their opposition to the bill, mostly due to its potential cost."

Bond Market Fallout

US borrowing costs top 5% after Moody’s downgrade - Ian Smith, William Sandlund, Kate Duguid, and Claire Jones, Financial Times:

US long-term borrowing costs climbed to their highest level since late 2023 and stock futures fell on Monday as the stripping of the country’s triple A credit rating and progress on President Donald Trump’s massive tax and budget bill fuelled concerns about the government’s mounting debt burden.

Yields on 30-year US Treasuries rose as much as 0.13 percentage points to 5.03 per cent on Monday, narrowly exceeding a peak reached during the tariff sell-off last month and putting the country’s long-term borrowing costs at their highest point since November 2023. Yields move inversely to prices.

Budgetary Effects of the May 2025 Tax Bill (Preliminary) - The Budget Lab. "If the provisions become permanent, the debt-to-GDP ratio would hit 200 percent in 2055. The only countries that currently have a higher debt-to- GDP ratio are Sudan and Japan."

Big Beautiful Bill Prospects, Potential Changes

Budget clears the reconciliation bill. GOP has a rough week ahead - Jake Sherman, John Bresnahan, Laura Weiss and Brendan Pedersen, Punchbowl News:

But Speaker Mike Johnson and top House Republicansstill have serious problems and a bruising negotiation ahead of them over the next few days. Both conservatives and moderate swing-seat Republicans are eyeing Johnson warily, afraid he’ll cave to the other faction on key issues including Medicaid spending cuts, taxes and clean-energy credits.

...

Let’s be clear here: A deal isn’t very close. The changes conservatives are seeking are drastic. Some of these tweaks are clearly unacceptable to moderates and the middle of the conference.

GOP to End Energy Tax Credits Earlier in Deal With House Leaders - Ari Natter and Jarrell Dillard, Bloomberg ($). "US House Republican hardliners said on Sunday they’d won a commitment from the House leadership to end energy tax credits sooner than originally planned, as part of a deal to allow President Donald Trump’s giant tax and spending package to advance out of a key committee"

The article provides no details on the reported agreement; other reports suggest a plan to cut off credits for existing projects by 2028.

EBay, PayPal Sellers’ Relief at Risk as Senators Chase Revenue - Zach Cohen and Erin Slowey, Bloomberg ($):

The House Ways and Means Committee approved legislation this week that effectively eliminates a provision of a 2021 law that significantly expanded the scope of who gets 1099-K forms to include taxpayers with more than $600 in gross payments.

House Republicans and their allies in the Senate have proposed returning to the $20,000 threshold for such requirements. It’s been a major priority for panel chair Rep. Jason Smith (R-Mo.), who has cast it as an attack on gig workers and an invasion of taxpayers’ privacy.

...

But other Republicans are pushing a partial rollback to bring in more revenue. A reversal would cost the Treasury $8.9 billion over the next decade, according to the Joint Committee on Taxation.

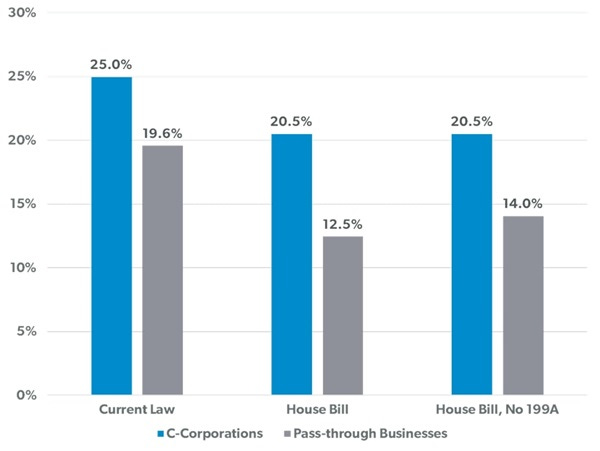

House Tax Bill Would Worsen Business Tax Parity - Kyle Pomerleau, AEIdeas:

The House proposal would increase the tax advantage for pass-through business investment by 50 percent. If the House proposal is enacted, the marginal effective tax rate on corporate investment would be 20.5 percent in 2026. Pass-through business investment, however, would face an even lower marginal effective tax rate: 12.5 percent—an eight percentage point advantage. While both business forms would benefit from the expensing provisions in the bill, pass-through businesses would also benefit from the three-percentage point Section 199A enhancement.

In fact, pass-through business investment would have an advantage under the House proposal even if 199A were allowed to expire. This is because most of the tax advantage for pass-through businesses in the House bill is due to expensing. Expensing eliminates the entire tax pass-through businesses pay on qualifying investments, but only eliminates the entity-level tax for C corporations. C corporate investment still faces the individual income tax. Expensing is also why 199A only marginally reduces the tax burden on pass-through business investments in the House bill.

IRS - Return of fired IRS staff; Billy Long hearings this week.

IRS Probationary Employees Asked to Return to Work by May 23 - Erin Slowey, Bloomberg ($):

The IRS and Treasury Department will bring back all IRS probationary employees who were on administrative leave by May 23, according to a email seen by Bloomberg Tax.

About 7,000 probationary workers were fired in February as part of the broader effort by the Trump administration to shrink the federal government. Following court rulings, these workers were put on administrative leave and some were asked to come back full-time as the IRS considered them critical.

Astonishing.

Senate Panel to Grill IRS Pick on Dubious Tax Credits, Donors - Erin Schilling and Chris Cioffi, Bloomberg ($):

Senate Finance Democrats have prodded Long and companies tied to him about the promotion of so-called sovereign tribal tax credits, the existence of which was disclosed by Bloomberg Tax last December. Ron Wyden (D-Ore.), the panel’s ranking member, and committee member Sen. Catherine Cortez Masto (D-Nev.) asked the IRS in April to open a criminal investigation into the firms that promoted the credits.

Long’s ethics disclosures show that he earned money from White River Energy Corp., the credits’ sponsor, and another company that has promotional materials for the credits on its website. He also received recent campaign contributions, years after his failed Senate run, from people associated with White River and other promoters that were large enough to pay off his campaign debts.

Wyden and Cortez Masto have demanded to know whether Long has a deal with White River to legitimize the tax credits.

Tariffs Threat

Trump Says Walmart Shouldn’t Blame Tariffs for Higher Prices - Skylar Woodhouse, Bloomberg ($):

President Donald Trump said Walmart Inc. should stop trying to blame tariffs as the reason for raising its prices, as the company warned it would this week.

“Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain. Walmart made BILLIONS OF DOLLARS last year, far more than expected,” Trump said in a post on Truth Social Saturday. “Between Walmart and China they should, as is said, “EAT THE TARIFFS,” and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!”

Blogs and Bits

As an American, Pope Leo XIV also must answer to IRS - Kay Bell, Don't Mess With Taxes. "As a U.S. citizen living and working abroad, Pope Leo XIV still must abide by the Internal Revenue Code. So, since U.S. tax law requires all citizens to pay taxes on their worldwide income, he’ll have to file a return and pay tax on his earnings like all the rest of us Internal Revenue Service subjects."

Related: Eide Bailly Expatriate Tax Services.

Three Hobby Loss Developments And The Romanowski Judgement - Peter Reilly, Forbes. "If there is a Schedule C running large losses every year, you need to think about and document the Section 183 issue every year not rely on a judgement made far in the past."

House “One Big Beautiful Bill” Riddled with Temporary Tax Policy - Erica York, Tax Policy Blog:

The bill provides several additional tax cuts for individuals available for tax years 2025 through 2028, expiring after President Trump’s term ends. It would increase the maximum child tax credit by $500 and the standard deduction by $1,000 for single filers, $1,500 for head of household filers, and $2,000 for joint filers. It would create several deductions, including for tip income, the “half” portion of time-and-a-half overtime pay, senior citizens, auto loan interest, and charitable giving for non-itemizers as well as a tax credit for contributions to scholarship granting organizations (available from 2026 to 2029).

The new deductions make tax policy worse.

18th Anniversary of the 21st Century Taxation Blog - Annette Nellen, 21st Century Taxation. "My goal in creating this website and blog was to highlight how tax systems can be improved to reflect how we live and do business today and to reflect principles of good tax policy."

Congratulations, Annette! A lot more blogs last less than a month than hold on for 18 years.

I see scammers

Long-time fugitive extradited to the United States to face charges for orchestrating mail fraud scheme defrauding elderly and vulnerable victims of over $10 million - IRS (Defendant name removed, emphasis added):

Defendant, a citizen of Germany, was indicted in 2020 and has been a fugitive. He was apprehended in Bolzano, Italy in 2024 and returned yesterday via Newark International Airport to face an indictment charging him with two counts of mail fraud. Defendant made his initial appearance and arraignment on May 9, 2025, before U.S. Magistrate Judge Leda Dunn Wettre. He pleaded not guilty and was remanded without bail.

According to the Indictment and statements made in court:

From at least 2011 through 2016, Defendant created numerous direct mail solicitations supposedly from world-renowned psychics, falsely and fraudulently claiming that the recipients were being contacted because they had been the subject of specific visions by the psychics, including visions that the recipients were going to receive large sums of money and good fortune. Many of the letters falsely promised that the psychic services being offered were free of charge. In fact, the letters were mass-produced using software and information provided by Defendant to a direct mail marketing services company, Company-1, located in Piscataway, New Jersey, which Defendant retained to print and mail the solicitations.

Defendant directed a second company, Company-2, to send fraudulent billing notices to the same victims that stated that the victims owed money for psychic services, which in many cases had been offered free of charge. The fraudulent billing notices were labeled “collection notices” and “invoices,” falsely representing that the victims owed late payment fees, and falsely stating that a psychic or astrology organization would refer the victim to a “collection agency” and take legal action if the victim did not send a check, usually for $20 to $50. Through his fraudulent psychic mailing campaign, Defendant obtained more than $10 million dollars from victims.

This is a reminder of how many ways scammers try to fleece the elderly and vulnerable.

As outlandish as the mass-mailed personalized psychic claims are, it's hard to say they are worse than the perfectly legal work of political fund raisers. We get intelligence-insulting text messages saying some politican is personally disappointed that we haven't sent him money lately because some people actually believe it. Keep an eye out for relatives and friends who might be at risk.

What day is it?

It's Frog Jumping Jubilee Day! Keep hop alive.

Any opinions expressed or implied are those of the author and not necessarily those of Eide Bailly. Items are for information only and are not tax advice.

Visit us at www.eidebailly.com!

About the Author

Joe B. Kristan CPA

Partner, Eide Bailly LLP

After 38 years centered on tax consulting for closely held businesses and their owners, Joe is joining Eide Bailly's National Tax Office. Joe's responsibilities include communication, process improvement and training. He is a principal contributor to the Eide Bailly Tax News and Views blog, providing daily updates on tax reform and other tax news. Joe is a Certified Public Accountant and a member of the AICPA Tax Section and Iowa Society of Certified Public Accountants.

Follow Joe on LinkedIn.